**eCloudvalley Digital Technology (TWSE:6689) Reports Strong Full Year 2023 Financial Results**

eCloudvalley Digital Technology (TWSE:6689) recently released its financial results for the full year 2023, showcasing impressive growth in key financial metrics.

**Key Financial Highlights**

– Revenue: NT$9.82b, marking a 14% increase from the previous fiscal year.

– Net income: NT$183.9m, representing an 83% surge from FY 2022.

– Profit margin: 1.9%, up from 1.2% in the prior year, driven by higher revenue.

– EPS: NT$2.70, a significant improvement from NT$1.61 in FY 2022.

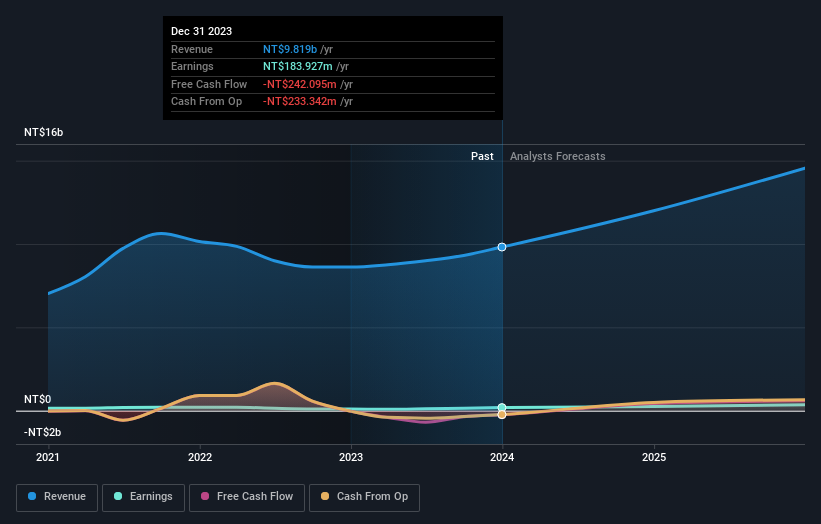

The company’s performance is visually depicted in the chart below:

*All figures shown in the chart above are for the trailing 12-month (TTM) period.*

**eCloudvalley Digital Technology Earnings Insights**

Looking ahead, eCloudvalley Digital Technology is poised for continued growth, with revenue forecasted to expand by 20% annually over the next 2 years, outpacing the projected 8.8% growth for the IT industry in Asia.

*Performance of the market in Taiwan.*

Moreover, the company’s share price has remained relatively stable compared to the previous week.

**Risk Analysis**

While eCloudvalley Digital Technology has shown impressive financial growth, it’s important to note that risks still exist. One warning sign has been identified for the company that investors should be mindful of.

**Valuation Analysis**

Valuation can be complex, but Simply Wall St provides a simplified analysis to determine if eCloudvalley Digital Technology is potentially over or undervalued. The comprehensive analysis includes fair value estimates, risks and warnings, dividends, insider transactions, and financial Health.

*Looking for a detailed valuation analysis? [View the Free Analysis](link to analysis)*

**Feedback and Disclaimer**

If you have feedback on this article or if you have concerns about the content, feel free to get in touch with us directly or email the editorial team at editorial-team@simplywallst.com. It’s important to note that this article by Simply Wall St is based on historical data and analyst forecasts and does not constitute financial advice. Our goal is to provide unbiased analysis driven by fundamental data, but it’s essential to conduct your own research before making investment decisions. Simply Wall St holds no position in any stocks mentioned.

Read More Technology News